When it comes to investing, most people are chasing the big win — but the smartest investors are doing something a little less flashy… and a lot more powerful.

They’re managing their risk.

Because here’s the deal:

Making money matters, yes — but avoiding big losses?

It’s just as important — if not more.

One of the best ways to manage risk without trying to “time” the market is something called dollar-cost averaging. It’s a simple concept, but it can make a huge difference — especially when the market is all over the place.

Dollar-cost averaging is a fancy term for a simple idea:

👉 You invest the same amount of money on a regular schedule — no matter what the market is doing.

Let’s walk through it using real numbers.

Dollar Cost Averaging

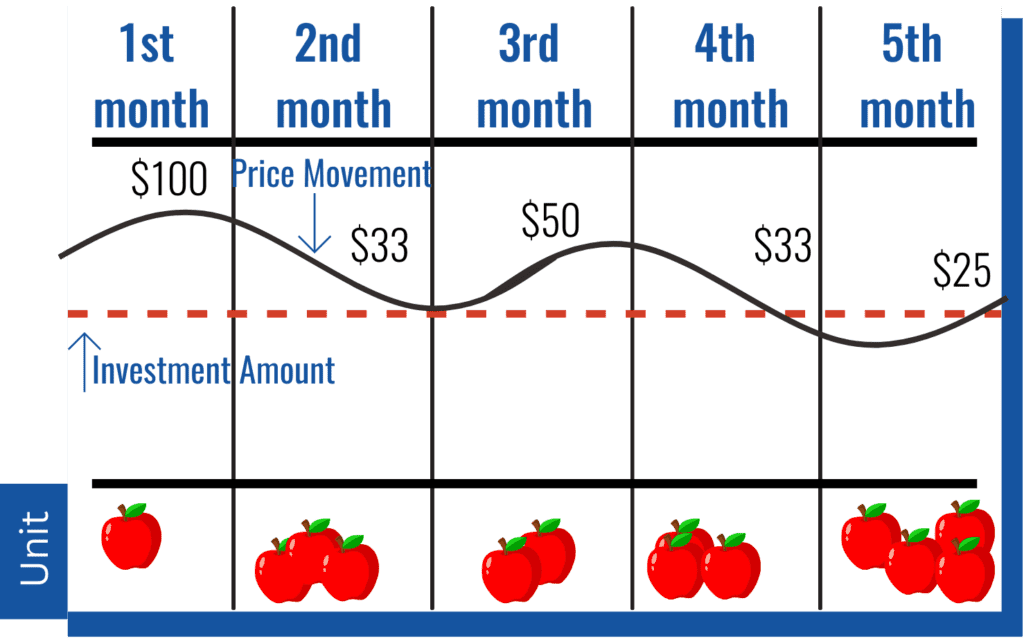

Imagine you invest $100 a month for five months, no matter what the market is doing. Here’s what that could look like:

✓ Month 1: The price per share is $100 → you buy 1 share

✓ Month 2: Price drops to $33 → you buy 3 shares

✓ Month 3: Price rises to $50 → you buy 2 shares

✓ Month 4: Back to $33 → you buy 3 shares

✓ Month 5: Drops again to $25 → you buy 4 shares

By staying consistent, you now own 13 shares in total.

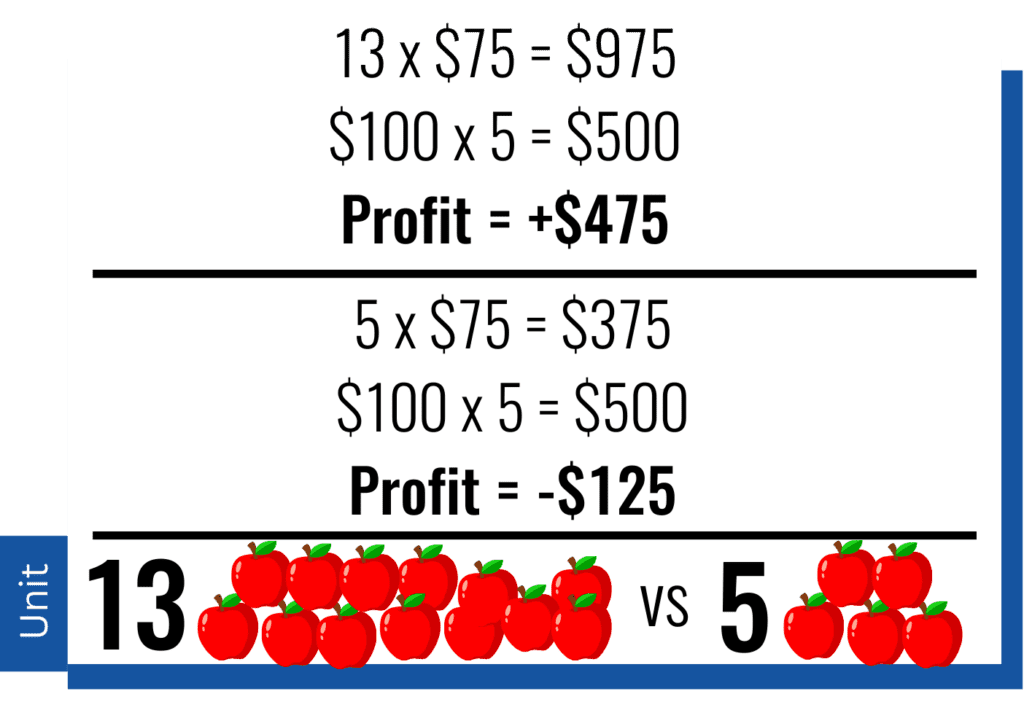

Then at month 6 the share price goes back up to $75, and you decide to sell.

13 shares × $75 = $975

You invested $100 for five months = $500 total

Your profit? $475.

That’s the power of dollar-cost averaging. You didn’t stress over the highs or lows. You just stayed consistent — and came out ahead.

But What If You Had Invested It All at Once?

Let’s say instead you put all $500 in during month 1, when the price per share was $100. That would have gotten you 5 shares.

Fast forward to month 6. The price is now $75.

5 shares × $75 = $375

That’s a $125 loss.

Same $500. Same investment. Totally different outcome.

That’s the risk of trying to time the market — and why dollar-cost averaging can help protect you when the market dips.

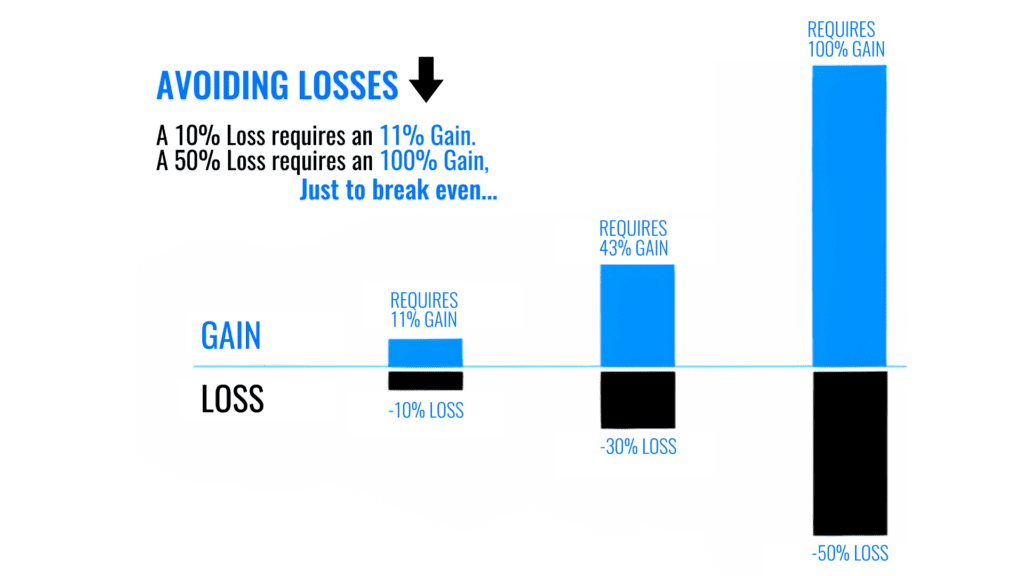

Why Losses Hurt More Than You Think

Here’s something a lot of people miss: when your investment drops, you don’t just need to gain the same percentage to recover — you need a lot more.

If you lose 50% of your investment, you don’t need a 50% gain to get back to where you started… you need 100%.

Example:

Start with $10,000

Lose 50% → now you have $5,000

Gain 50% → now you have $7,500

You’re still short $2,500.

That’s why protecting your downside — managing the risk of loss — is so critical. It’s not just about how much you make when things go well. It’s about what you keep when they don’t.

Bottom Line: Manage the Ride, Don’t Chase the High

Managing risk isn’t about avoiding the market. It’s about having a strategy that works no matter what the market is doing.

Dollar-cost averaging is one of those strategies. It helps you stay consistent, lowers your average cost, and takes emotion out of investing — all while setting you up for long-term growth.

And when you combine that with an understanding of how losses can impact your bottom line, you’re not just investing… you’re being smart about it.

Because at the end of the day, your goal isn’t just to invest. It’s to grow your money without losing it all along the way.