You filed your taxes, now what?

Maybe you’re relieved. Maybe you’re annoyed. Maybe your refund is already half gone.

Or maybe you just don’t want to think about taxes at all anymore.

Trust me, I get it…

But here’s the thing:

Tax season isn’t just a deadline. It’s a reset button.

The moment right after you file—AKA right now—is the best time to start thinking about next year’s taxes, finding ways to fix what slowed you down, cost you money, or made you say, “Ugh I’ll deal with that next time.”

So let’s get into 8 things you can do while you’re already in money mode—to prep for next year and start fresh with your entire financial plan.

✅ #1: Do a “subscription sweep”

Tax season forces you to look at your spending—so don’t let that awareness go to waste.

Ride the momentum and do a quick sweep of all your recurring charges.

Here’s how I do mine:

I open my bank and credit card apps and filter for keywords like “Apple,” “Spotify,” “membership,” “subscription,” or “renewal.”

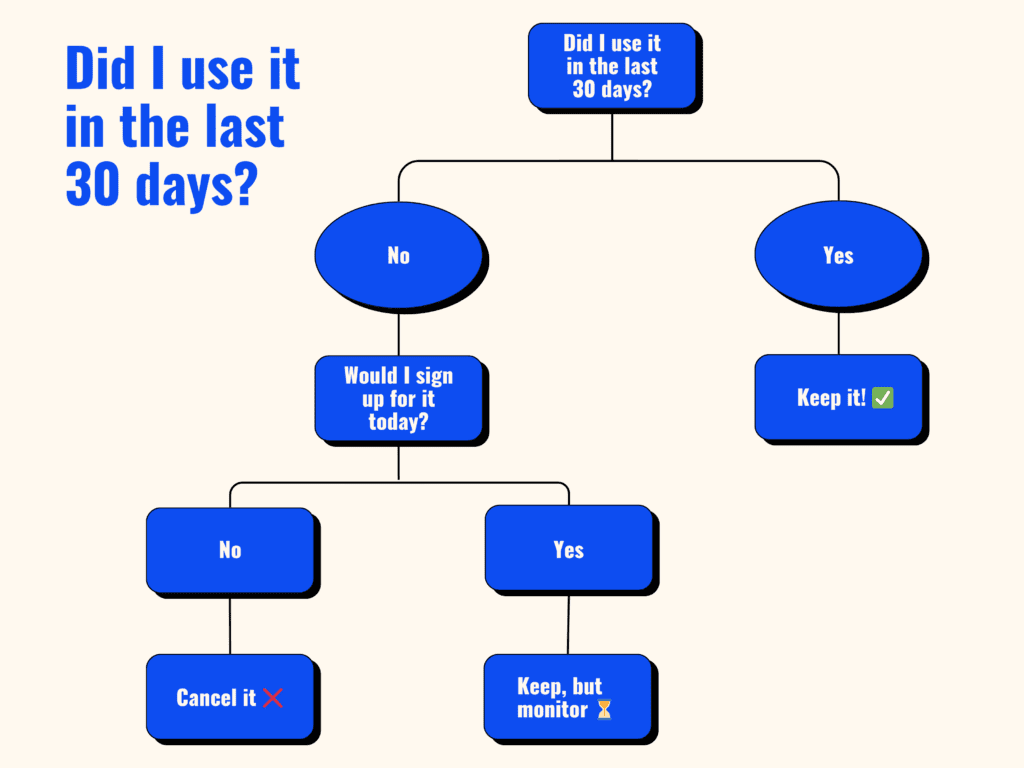

I scan the last two to three months of charges and put each one through a quick two-question test.

Most people find at least a couple of things to cut—I saved over $800 last year doing this and didn’t miss a single expense I cut.

(Plus, I discovered I was still paying for two different cloud storage plans I thought I canceled. Oops!)

✅ #2: Check your Social Security earnings record (seriously—do it)

I know it sounds boring…

But it can literally be worth thousands of dollars later.

Most people don’t know this, but the Social Security Administration keeps a record of your earnings every year.

Unfortunately, mistakes are more common than you’d think, especially if you:

- Switched jobs a lot

- Had gaps in employment

- Were self-employed

- Changed your name or moved around

- Had multiple sources of income (including side hustles)

So, what does that mean for you?

Well, if there’s a mistake on your Social Security record…

There can be a mistake on your future benefits, too.

I once worked with someone who had an entire year of work missing from their record. $80K in income just… not listed.

If he hadn’t caught it, his future retirement payout would have been permanently lower—all because of a mistake that a two-minute check could have fixed.

Here’s how to check yours:

- Go to the Social Security site and create an account or sign in

- Click on “Earnings Record” to see a year-by-year breakdown

- If anything’s missing or incorrect, follow the steps to fix it—sooner is better

Even if retirement feels far away—or Social Security seems like it’s on shaky ground right now—it’s still your money, and your record needs to be accurate if you ever plan to collect it.

✅ #3: Create a “next year’s deduction” experiment

Every year during tax season, my accountant inevitably asks the same few things.

Questions like, “Did you track your home office expenses?” or, “Do you have receipts for those business meals?”

And I used to freeze.

Not because I didn’t think I spent the money…

But because I didn’t have the records.

I’d start digging through old emails, scrolling through my calendar, and trying to match charges to client meetings from six months ago, all while thinking, “Next year I’m going to get ahead of this.”

Until one year I tried something different.

I didn’t overhaul my entire system or create ten new spreadsheets.

I just chose one thing to track:

Business meals.

After every business meal, I’d write who I met with and what we discussed on the receipt. Then, I’d snap a quick photo and upload it to my (newly created) “Business Meals” folder.

It took 10 seconds.

By the end of the year, not only did I have clean records… but it actually helped me become more mindful about where and how I was spending money in the business.

And the deduction? Way better than the year before.

So here’s your move:

Pick one deduction you missed, guessed at, or scrambled to document this year, and experiment with ways to track it better than you did this year.

Whatever you try, remember that you don’t need to be perfect—you just need to be proactive while the expense is still fresh in your mind.

You’ll thank yourself for it during next year’s return.

✅ #4: Review (or create) your basic estate plan

This one might feel a little “extra” if you’re not at retirement age or don’t have millions in the bank…

But let me say this as clearly as possible:

If you have a child, a bank account, or an opinion about who should not get your assets, you need an estate plan.

I remember the first time I seriously thought about mine.

I was pregnant with my first child, and it hit me out of nowhere:

“What happens to my child if something happens to me?”

Not just emotionally, but logistically. Who would handle everything I’d built? Who would raise my child the way I would want?

At the time, Luis and I didn’t have anything extravagant—we weren’t millionaires with tons of fancy properties.

But we did have investment accounts, business accounts, life insurance, and a baby on the way who would depend on us for everything

If you’ve ever assumed, “Well, my family would figure it out,” I can tell you from experience working with families who didn’t have an estate plan that they probably won’t (or at least not without stress, court delays, or unnecessary costs).

So here’s what I suggest:

Don’t overthink it. Don’t wait until you feel “wealthy enough.”

Do it now, and just start with the basics:

- A will

- A healthcare proxy

- A durable power of attorney

- Beneficiaries updated on all accounts (life insurance, retirement, etc.)

There are plenty of affordable ways to get started.

You can create a simple will online for a couple hundred dollars, or you can work with an estate attorney for more complex needs.

Remember: this isn’t about expecting the worst.

It’s about making sure the people you love don’t have to guess what you would have wanted.

(By the way—The World Changers Network’s Premium Membership gets you access to a free online will!)

✅ #5: Set your “Money Date” calendar for the year

I used to rely on memory, mood, and momentum to manage my finances.

If I felt on top of things, I’d check accounts, look at goals, and maybe tweak some numbers.

But if life got busy? Months could go by without a real check-in.

Then I started doing what I now call a “Money Date.”

Once a month. Non-negotiable. Just like a team meeting or a doctor’s appointment. No fancy software, no spreadsheets required. Just a recurring 30- to 60-minute block where I look at:

- What money came in

- What money went out

- What responsibilities are coming up

And yes—I literally put it on my calendar.

I do it myself first, because I take the lead on managing the finances in our household.

But then Luis and I have a little recap—a quick catch-up on what’s happening, what’s changing, and what we might want to shift. He’s always clued in, which helps us stay aligned with our financial goals.

Here’s how to plan your own Money Date:

- Pick your rhythm. Monthly works best for most people. Put it on your calendar for the same day/time each month.

- Choose a vibe. Coffee shop? Wine at home? Morning silence? Make it feel good so it actually happens.

- Use a simple template. Start with 3 questions:

👉 What surprised me this month (financially)?

👉 What progress did I make on my goals?

👉 What do I need to adjust?

There’s no “right” way to do this.

You can plan your Money Date however you want… as long as you actually do it.

Staying on top of your finances regularly is the only way to truly know whether you’re on track to reach your financial goals—because memory and mood aren’t enough.

✅ #6: Revisit your business structure (for business owners)

If you’re self-employed or run a business, your tax return wasn’t just paperwork— it was a report card.

And for a lot of people, that report card comes with a painful realization:

“Why am I paying so much in taxes?”

I’ve been there. I remember one year early in my career, my income had jumped—a good thing—but my tax bill made me feel like I got punched in the gut.

I wasn’t doing anything wrong, I just hadn’t set up my business structure in the most strategic way.

I was operating as a sole proprietor when I could’ve been paying myself differently, deducting more, and keeping way more of what I earned.

That was the year I learned about the S-Corp election—and how changing your business structure can sometimes save thousands in self-employment taxes. It’s not always the right move for everyone, but it was a total game-changer for me.

So if your tax bill felt high this year, don’t just accept it as the cost of doing business.

Ask:

- Am I structured the right way for the income I’m making now?

- Would switching to an S-Corp give me more flexibility or savings?

- Should I be working with someone who specializes in business tax strategy?

Even if you’re not ready to make changes yet, just having the conversation can open up options and help you plan better for next year.

And the best time to have that conversation?

Right after filing, when everything’s fresh and you still have time to adjust before the year’s over.

Still confused about S-Corps? Read more about them here.

✅ #7: Refresh your financial document system

Let’s be honest: most people’s financial “filing system” is a mess.

Some things are in a drawer. Others are floating around email inboxes. A few are saved on your desktop in a folder called “Important Stuff” that hasn’t been touched in two years.

And it’s fine—until you need something.

I learned this the hard way when we were buying our house.

I remember needing to submit multiple years of tax returns, bank statements, insurance documents—all on a tight deadline.

I had everything… but finding it all was a headache.

It took me hours to track down files across email, Google Drive, and old folders on my laptop—and at one point, I even had to call my accountant to resend something I’d already received months earlier.

That was the moment I realized: being organized isn’t just about being neat.

It’s about being ready.

Now, once a year—right after tax season—I do a quick financial clean-up. Nothing fancy. Just enough to make sure I know where everything is, and anyone who needs it could find it too.

Here’s how I do it:

- Create a “Financial Vault” folder. Physical or digital—just one central place for your most important documents.

- Label things clearly. Think: “2024 Taxes,” “Life Insurance,” “Estate Plan,” “Banking + Credit,” etc.

- Back it up. I store mine in the cloud with limited shared access, so Luis can find it all too if something ever happened to me.

Get rid of what’s outdated. Expired policies, old loan docs, duplicate statements—let them go.

You don’t need to be perfectly organized.

You just need to be prepared.

✅ #8: Start a “life events” plan

Here’s something I’ve learned after 20+ years helping people with their finances:

Life doesn’t wait for you to be financially ready.

It just… happens.

You get a raise. You move. You lose a job. You get pregnant. You buy a house. You get married. Someone gets sick. Someone needs help.

And every single one of those moments comes with a financial ripple effect.

That’s why one of the best things you can do after filing your taxes is take a breath—and look ahead.

Ask yourself:

What big life events could happen this year?

You don’t need a crystal ball. You just need a list.

For example:

- Planning to move?

- Thinking about having a baby?

- Expecting a raise… or could a potential layoff be coming?

- Launching a business or side hustle?

- Sending a kid to college?

- Supporting aging parents?

When you can name the possibilities, you can start thinking about how to prepare for them—financially, logistically, emotionally.

Even just acknowledging what might be coming makes you more intentional with how you spend, save, and plan.

For me, this has become part of my post-tax routine.

I literally open my calendar, glance at what’s ahead, and ask:

What in my life could impact my money —or be impacted by it—in the next 6 to 12 months?

It’s simple. It’s quick. And it’s one of the best ways to go from reactive to proactive.

Wrapping up

You don’t have to do everything on this list.

But doing something while your taxes are still fresh —and your financial brain is warmed up—can set the tone for the whole year.

The goal here isn’t to be perfect.

It’s to stay one step ahead—not just with your taxes, but with your whole financial plan.