Question:

❓Which habit leads to the worst investment results over time?

A) Holding during market drops

B) Not checking your portfolio

C) Panic selling during volatility

D) Investing in index funds

Answer:

✅ C) Panic selling during volatility

Here’s why:

Panic selling is one of the most damaging investor behaviors.

When markets drop, many people sell out of fear—locking in losses and missing the eventual recovery.

Studies show that the average investor significantly underperforms the market not because of what they invest in, but when they choose to get in and out.

Here’s the punchline:

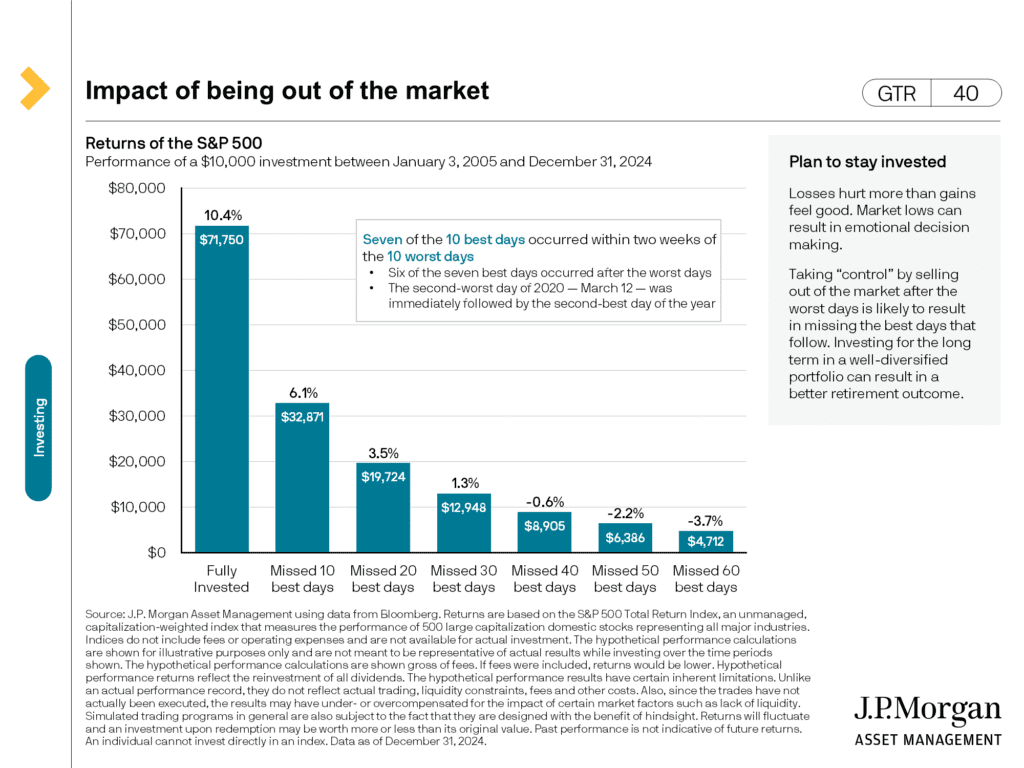

Missing just the 10 best days in the market over a 20-year period can cut your returns in half.

And when do most of those “best days” happen? Right after the worst ones.

For example from 2005 to 2024, the S&P 500 returned an average of 10.4% annually—but investors who missed the best 10 days saw only 6.1%. Miss 20 days? You’re down to 3.5%. Miss 40? Your return goes negative.