Understanding money is a game-changer. By learning how to manage your finances and having the right mindset, you can take control of your money and improve your financial well-being.

Here are some simple steps to help you get started.

Understanding Financial Mindset

Your financial mindset is how you think and feel about money. A positive mindset can help you make better money decisions. For example, if you believe you can save money, you’re more likely to do it. On the other hand, if you think money is always a struggle, it might be harder to save or spend wisely. Changing how you think about money is the first step to mastering your finances.

Start by noticing your thoughts about money. Are they mostly positive or negative? If you catch yourself thinking, “I’ll never have enough,” try changing that to, “I can find ways to save and earn more.” This simple shift can make a big difference over time. It’s also helpful to surround yourself with positive influences, like financial success stories, podcasts, or books and a network of like-minded individuals. The more you see that financial success is possible, the more you’ll believe it for yourself.

Financial Literacy

Financial literacy means knowing how to handle your money. Start with the basics: understanding your income and expenses, saving money, and knowing the basics of investing and managing debt. To get better at this, take online courses, use financial calculators or apps that help you track your money. Begin by tracking your income and expenses for a month. This will show you where your money is going and where you can cut back.

Next, learn about saving. Make saving the first ‘expense’ you pay each month—pay yourself first. Set aside an amount of money each month, even if it’s just a few dollars. Over time, this will add up. Also, get familiar with the basics of investing. You don’t need to be an expert, but understanding how to grow your money is important.

Lastly, understand debt. Know the difference between good debt (like a mortgage) and bad debt (like high-interest credit cards), and make a plan to manage or pay off any bad debt you have.

(—You can learn more about many of these topics in the courses on TWC Network!)

Using Financial Tools and Resources

There are many tools to help you manage your money. Financial calculators available through The World Changers Network App resources can help you understand how much you need to save for big goals.

For investing, WealthFlex is a great platform to help you grow your money. These tools can give you a clear picture of what you need to do to reach your goals and make managing your money simpler and more efficient.

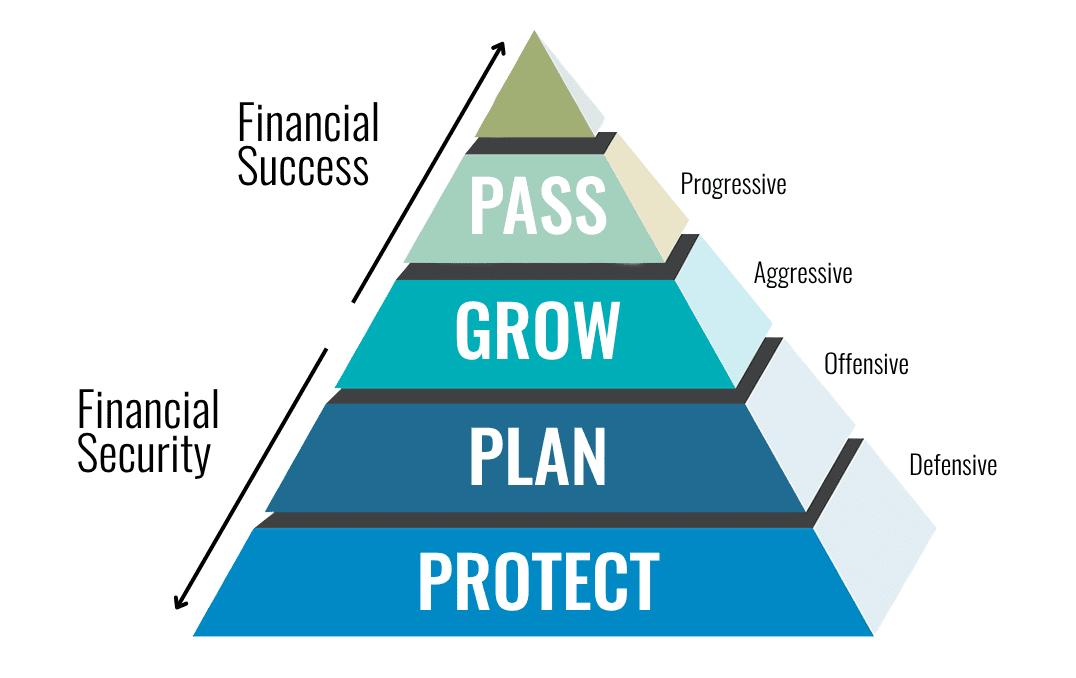

Setting Financial Goals

Having clear financial goals gives you something to work towards. Think about what you want to achieve in the short term, like saving for a trip, and in the long term, like buying a house or retiring comfortably. Make your goals specific and realistic. For example, instead of saying you want to save more, aim to save $100 a month.

Start by writing down your goals. Make them as specific as possible. For example, instead of “save money,” write “save $1,000 for an emergency fund by the end of the year.” Break your goals down into smaller, manageable steps. If your goal is to save $1,000, figure out how much you need to save each month to reach it. Having these clear, specific goals will keep you motivated and on track.

Creating a Financial Plan

A financial plan helps you reach your goals. Start by looking at your current financial situation: how much money you have, how much you owe, and what you spend each month. Then, create a budget that includes saving for your goals. Plan where your money will go each month to ensure you’re on track.

Begin with a simple budget. List your income and all your expenses. Include everything, from rent to coffee. This will give you a clear picture of where your money is going. Next, look for areas where you can cut back. Maybe you can cook more at home instead of eating out. Use the money you save to work towards your goals. Make sure your budget includes some fun money, so you don’t feel deprived. Finally, review your budget regularly and adjust as needed. Life changes, and so should your budget.

(–Connect with a Financial Professional so you don’t have to go at it alone!)

Mastering your finances starts with understanding your mindset, learning the basics of money management, setting clear goals, creating a plan, and using the right tools. By taking these steps, you can change your finances and improve your life.