Planning for your financial future is more than just saving and investing; it’s about taking a holistic view of your financial life. This means looking at all aspects—from budgeting to estate planning—to ensure a comprehensive strategy that can adapt to life’s complexities.

In this blog, we’ll explore why a holistic approach is vital and highlight the key areas to focus on to build a resilient financial future.

Budgeting and Cash Flow Management

The foundation of any solid financial plan starts with understanding your cash flow. Knowing what comes in and what goes out each month is crucial. This isn’t just about keeping tabs on spending or sticking to a budget; it’s about gaining insights into your financial habits. From here, you can identify opportunities to optimize your savings and even discover potential financial pitfalls before they become problematic.

Effective cash flow management also involves looking ahead. It’s not enough to know your current financial status; you need to plan for upcoming expenses, whether they are as predictable as annual insurance premiums or as variable as home repairs. By maintaining a clear view of your finances, you can avoid debt and build savings more effectively, paving the way for financial stability.

Investment and Wealth Building

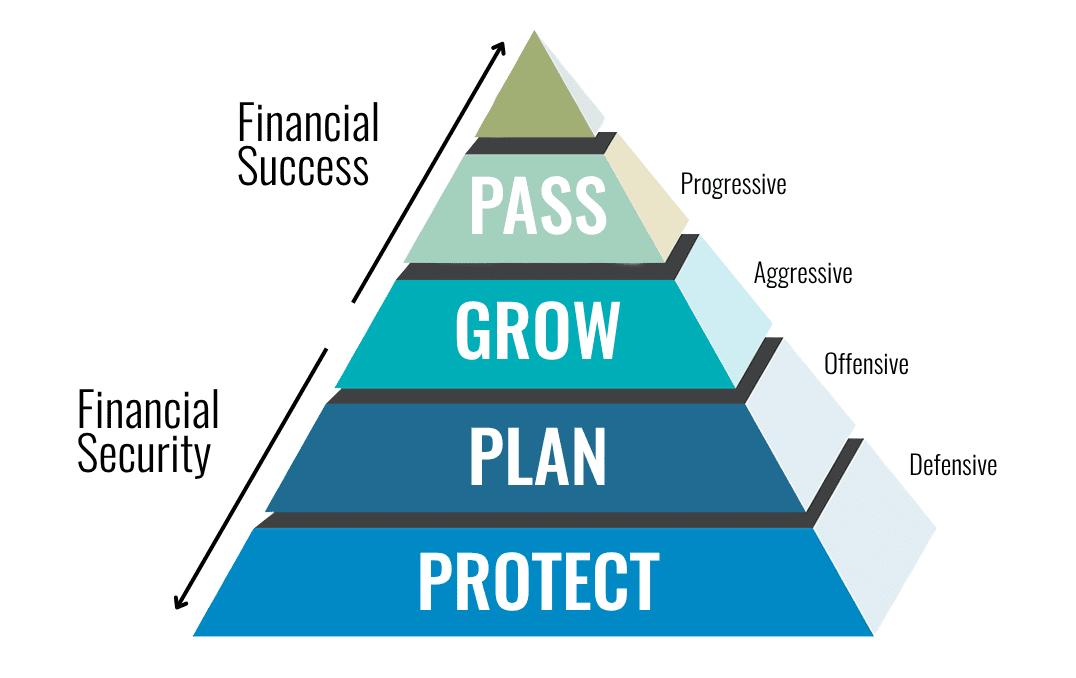

Investing is a critical component of financial planning, essential for wealth building and achieving long-term goals like retirement or funding a child’s education. However, it’s not just about choosing the right stocks or funds. A holistic approach assesses your personal risk tolerance, time horizon, and financial goals. This tailored strategy ensures that your investments align with your overall financial plan and life goals.

Also, diversification is key. It’s important to spread your investments across different asset classes to mitigate risk. Whether you’re investing in the stock market, bonds, real estate, or other vehicles, understanding how each fits into your broader financial picture is crucial. This strategy not only maximizes potential returns but also provides a safety net during economic downturns.

Risk Management and Insurance

No financial plan is complete without considering potential risks. This includes not just investment risks but also life uncertainties. Insurance plays a pivotal role here by providing financial protection against unforeseen events. From health insurance to life and disability coverage, the right insurance policies act as a buffer, protecting you and your family’s financial well-being.

The types of insurance you need will depend on various factors such as your life stage, family responsibilities, and financial obligations. For instance, if you are the primary breadwinner, life insurance is indispensable. Similarly, as you age, long-term care insurance might become a priority. Assessing these needs as part of a holistic financial plan ensures that you are well protected against life’s uncertainties.

Your Birdseye View with The World Changers

At The World Changers, we’re committed to providing you with a comprehensive, 360-degree view of your financial landscape. We understand that each component of your financial life is interconnected, and our holistic approach reflects that. Our team works closely with you to identify and align your financial goals with personalized strategies, from budgeting and investments to risk management.

We utilize advanced tools and resources to offer you insights and options tailored to your specific circumstances. Our financial professionals are dedicated to helping you navigate each aspect of your financial journey, ensuring that you not only reach your financial goals but also understand and feel confident about the strategies we employ. Together, we are setting the stage for a lifetime of financial success and stability.