As tax season approaches, it’s essential to consider not only how to file your taxes efficiently but also how to use your tax returns wisely to build and grow your wealth. This strategic guide will walk you through key steps to make the most of tax-time financial planning, so you can secure your financial future.

- Assess Your Current Financial Situation:

Before diving into tax planning, take a moment to assess your current financial status. Calculate your net worth, review your income and expenses, and identify any outstanding debts. Understanding your financial picture will help you make informed decisions. - Maximize Tax Deductions and Credits:

One of the primary ways to optimize your tax return is by taking advantage of tax deductions and credits. Common deductions include mortgage interest, student loan interest, and charitable contributions. Work with a CPA to make sure you claim all eligible deductions and credits to minimize your tax liability. - Contribute to Retirement Accounts:

Contributing to retirement accounts like a 401(k) or IRA can reduce your taxable income while saving for your future. Take advantage of these tax-advantaged accounts and consider increasing your contributions if possible. - Explore Investment Opportunities:

Tax refunds can be an excellent source of capital to start or boost your investment portfolio. Consider investing in stocks, bonds, or ETFs to grow your wealth over time. Consult with a financial advisor to make informed investment decisions that align with your goals. - Pay Down High-Interest Debts:

If you have high-interest debts, such as credit card balances, consider using your tax refund to pay them down. Reducing or eliminating these debts will save you money on interest payments and improve your overall financial health. - Establish an Emergency Fund:

Financial emergencies can happen at any time. Use a portion of your tax return to establish or bolster your emergency fund. Aim to have at least three to six months’ worth of living expenses saved in an easily accessible account. - Consider Tax-Efficient Investments:

When making investment choices, think about tax-efficient strategies. Investments like index funds, tax-managed funds and also alternative options such as cash value life insurance can help minimize the tax impact on your returns, allowing you to keep more of your money. - Consult with a Professional:

Tax laws can be complex and change frequently. To ensure you’re making the most of your tax-time financial planning, work with a tax professional together with a financial professional. They can provide personalized advice based on your unique situation. - Create a Long-Term Financial Plan:

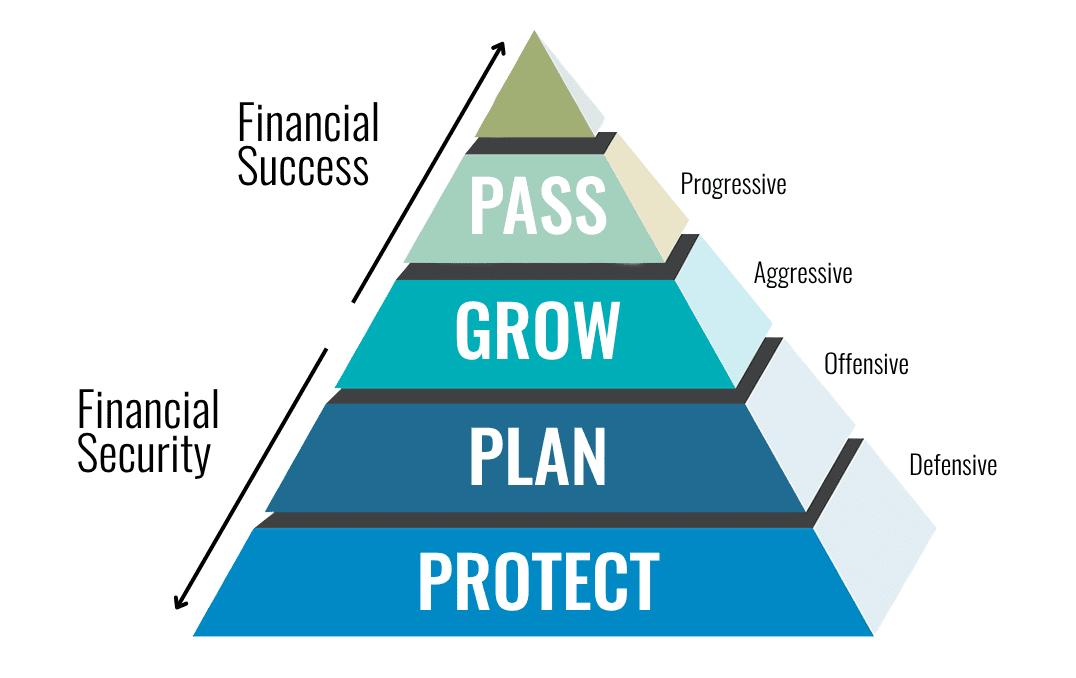

Tax refunds are just one piece of the financial puzzle. Develop a long-term financial plan that includes goals for retirement, asset management, education, and more. Regularly review and adjust your plan with your licensed financial professional as your financial situation evolves. - Practice Discipline and Patience:

Building wealth through tax-time financial planning requires discipline and patience. Avoid impulsive spending and focus on your long-term financial goals. Over time, your efforts will pay off, and your wealth will continue to grow.

Tax time is an excellent opportunity to take control of your financial future. By following these strategic steps and making wise decisions with your tax returns, you can establish a solid foundation for building and growing your wealth.

Remember, when you change your finances, you change your world.