Most people have bits and pieces of a financial plan. A 401(k) here. A life insurance policy there. A few savings goals, a stock tip from a friend, maybe a will they haven’t looked at in years.

What they don’t have is a full strategy—and definitely not one built in the right order.

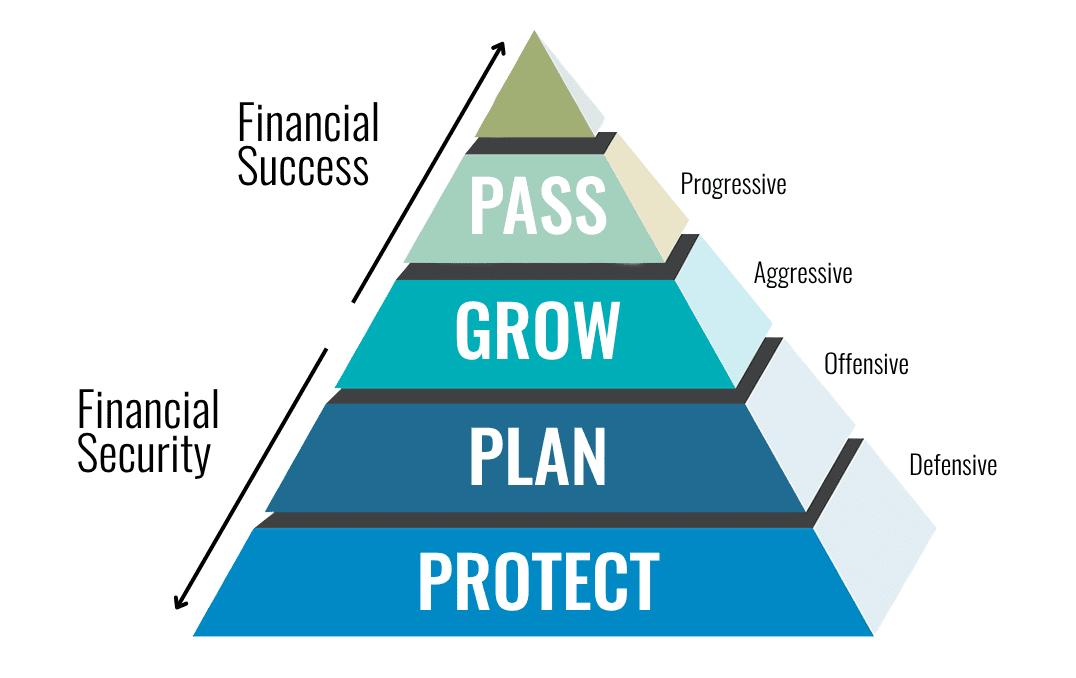

That’s what the Needs Pyramid is for.

It’s a simple framework to map out your financial priorities by separating financial security from financial success.

Because they are not the same thing.

And if you try to chase success before you have security, the whole thing can collapse.

Financial Security vs. Financial Success

Let’s define it clearly.

Financial security is your defense. It’s the part of your plan that protects what you have, keeps you from going backward, and gives your family stability no matter what happens.

Financial success is your offense. It’s about growing your wealth, investing wisely, expanding your legacy, and aligning your money with your mission.

You need both—but not at the same time. And not in any order you choose.

The Needs Pyramid gives you a system for layering each piece of your strategy so that one step strengthens the next.

Here’s how it works.

DEFENSIVE: The Foundation

Main Goal: Protect what you have

This is the base of the pyramid—your financial defense. And if you skip it, everything else is built on risk.

Protection means covering what you already have:

- What you earn (your income)

- What you own (your assets)

- Who you love (your family)

This layer includes:

- Income protection (disability insurance, emergency fund)

- Life insurance (to protect your family or cover debts)

- Health coverage (major medical, long-term care)

- Basic estate planning (will, power of attorney)

If you lost your paycheck tomorrow, how long would your family be okay?

If you passed away unexpectedly, would they be able to stay in the house? Keep their lifestyle?

It’s not glamorous. But it’s what keeps your life from falling apart if something unexpected happens. It’s your “stay in the game” money—not “get ahead” money.

If you haven’t built this layer, you don’t need to be thinking about investments yet. Because you can’t build a future if you’re constantly one emergency away from starting over.

OFFENSIVE: The Structure

Main Goal: Plan for the Big Stuff

Once your defense is strong, you can go on offense—planning for the expenses you know are coming.

This includes:

- Emergency fund (3–6 months)

- Short-term savings goals (car, vacation, new home)

- Debt elimination strategy (especially high-interest)

- Retirement savings (401(k), IRA contributions)

- College funding (529s or alternatives)

This layer is about cash flow, timing, and predictability. It’s where you start thinking ahead—not just reacting to what life throws at you.

Most families stuck in the cycle of “make more, spend more” never get this part fully organized. Pulling from retirement to pay for braces. Taking on credit card debt to fix the A/C.

Planning doesn’t mean predicting everything—it means being ready for anything.

AGGRESSIVE: The Growth Layer

Main Goal: Grow your wealth

This is where most people start—and that’s why they end up frustrated.

When you go through the first two layers, you’re protected, you’re organized—and now you can build.

This is where investing and wealth-building strategies show up:

- Max out your retirement accounts

- Open Investment accounts

- Business expansion

- Real estate investments

But it’s not about throwing money at the market. It’s about putting your dollars to work in a way that matches your risk tolerance, time horizon, and values.

Here’s the key: If you skip straight to this layer without the two below it? You’re not investing. You’re gambling.

PROGRESSIVE: The Purpose Layer

Main Goal: Align your money with your mission.

This is the top of the pyramid. The layer that only works when everything underneath it is solid.

Once your present and future are secure, you can start thinking about your legacy.

At this level, your money serves a bigger vision. You’re not just thinking about rates of return—you’re thinking about return on life.

That could mean:

- Structuring charitable giving through donor-advised funds

- Setting up legacy trusts for kids or grandkids

- Supporting causes or communities that matter to you

- Buying time—early retirement, sabbaticals, time with family

This layer is personal. Powerful. And totally out of reach if your strategy is chaotic or out of order.

Why the Order Matters

Each layer supports the one above it.

If you try to jump straight to growth strategies without protection in place, you risk losing everything in a single moment.

If you chase retirement without fixing your cash flow or building savings, you’ll end up borrowing from the future to survive the present.

And if you try to live your purpose before your financial life is stable, you’ll stay stuck in survival mode—dreaming, but never doing.

The order isn’t about perfection. It’s about readiness.

So Where Do You Begin?

Start at the bottom.

Protect. Plan. Grow. Pass on.

Every layer builds on the one before it. And when it’s done right, you don’t just have money. You have financial security and financial success. You feel steady, clear and empowered.

Not sure where your gaps are? That’s exactly what we help you figure out.

Schedule a time with a financial professional and we will walk you through it.