Taxes can be confusing, especially when you hear terms like “tax brackets” and “marginal rates.”

Let’s break it down in simple terms so you can finally understand how tax brackets actually affect your income—and what you can do to lower your bill.

What Are Tax Brackets?

Think of tax brackets like steps. The more you earn, the higher you step—but only the income that lands on each step gets taxed at that rate. This is called a progressive tax system, and it means:

– Low income is taxed at low rates.

– Higher income is taxed at higher rates—but only the portion of your income in that range.

So when people say “you’re in the 22% tax bracket,” it doesn’t mean all your income is taxed at 22%—just the chunk that falls into that bracket.

That 22% is your marginal tax rate—it’s the rate applied to your last dollar of income.

So if you earn a little more money (from a raise or side hustle), it gets taxed at your marginal rate, not your average. Your overall tax bill still includes lower rates on the income that falls in the lower brackets.

What Tax Bracket Am I In?

Here are the IRS federal income tax brackets for single filers in 2025:

– 10% on income up to $11,925

– 12% on income from $11,926 to $48,475

– 22% on income from $48,476 to $103,350

– 24% on income from $103,351 to $197,300

– 32% on income from $197,301 to $250,525

– 35% on income from $250,526 to $626,350

– 37% on income over $626,350

Note: These brackets are for single filers in 2025. If you’re married filing jointly, head of household, or want the most up-to-date rates, check the IRS website.

Let’s Look at an Example

You’re a single filer making $60,000 in taxable income.

Here’s how your federal tax breaks down:

– First $11,925 @ 10% = $1,192.50

– Next $36,550 ($11,926 to $48,475) @ 12% = $4,386.00

– Final $11,525 ($48,476 to $60,000) @ 22% = $2,535.50

Total tax = $1,192.50 + $4,386 + $2,535.50 = $8,114.00

Even though you’re in the 22% tax bracket, you’re not paying 22% on all your income—your effective tax rate is about 13.5% ($8,114 ÷ $60,000).

How Does My Retirement Contribution Affect My Tax Rate?

This is where things can get interesting—and potentially save you money.

Let’s say you put $6,000 into a Traditional IRA.

That money doesn’t count as taxable income right now.

So instead of paying tax on $60,000, you’re now taxed on $54,000.

Here’s the new breakdown:

– First $11,925 @ 10% = $1,192.50

– Next $36,550 ($11,926 to $48,475) @ 12% = $4,386.00

– Remaining $5,525 ($48,476 to $54,000) @ 22% = $1,215.50

New total tax = $1,192.50 + $4,386 + $1,215.50 = $6,794.00

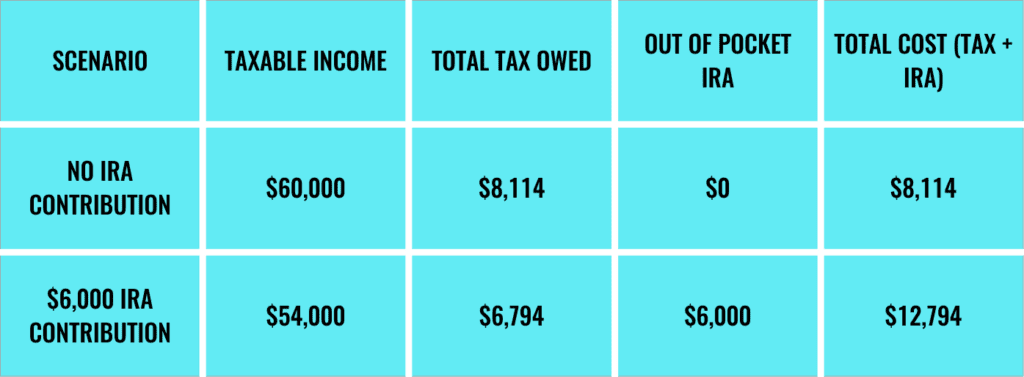

So What’s the Benefit?

You saved $1,320 in taxes this year ($8,114 – $6,794)

Your $6,000 contribution lowered how much was taxed at the highest rate (22%)

That $6,000 is now growing inside your retirement account—you didn’t lose it, you moved it

But let’s break that down even further:

But Don’t Forget About Later

That $6,000 you contributed? It’ll grow over time—which is great—but when you take it out in retirement, the entire amount is taxable.

So if it grows to $15,000, you’ll pay income tax on all $15,000 when you withdraw it.

That’s how Traditional IRAs work:

– Tax break now

– Taxes later

If you used a Roth IRA instead, you’d pay taxes on the $6,000 now, but it would grow tax-free, and you could withdraw it tax-free in retirement.

Taxes Don’t Have to Be a Mystery

Tax brackets aren’t something to be afraid of.

They’re just a system that taxes your income in chunks, not all at once.

And with a little strategy—like using retirement contributions—you can lower how much of your income is taxed at higher rates.