Life insurance isn’t just about preparing for the worst. It’s about protecting what you’ve built, supporting the people you love, and creating peace of mind for the future.

But there isn’t just one kind of life insurance. There are several types, each with different features, costs, and purposes.

If you’ve ever felt confused about what type of life insurance is best for you, you’re not alone. Let’s break it all down so it actually makes sense.

The Two Main Categories: Term and Permanent

Life insurance falls into two big categories: term and permanent. These are the foundation. From here, we can start to figure out what fits your needs, your goals, and your budget.

Term Life Insurance (Temporary Coverage)

Think of term insurance as “just in case” coverage. It protects your loved ones financially for a specific period of time—10, 20, or 30 years, for example.

Here’s how it works:

You choose a set number of years (this is your term). You pay the same premium every month during that time. If something happens to you during the term, your family gets the payout. If the term ends and you’re still alive, the policy ends and there’s no payout or cash value. And if you miss a payment, you lose the coverage.

Term is popular because:

It’s usually the most affordable. It’s simple and works well for short- or medium-term goals

But here’s the catch:

There’s no cash value—once the term ends, coverage is over (unless you renew at a much higher price).

When term life might be right for you:

- You want to cover a mortgage or debt for a set time

- You have kids and want to protect their financial needs until they’re grown

- You want coverage while your income is high but budget is tight

Think of it like renting. It gives you what you need now, but it doesn’t build anything for later.

Permanent Life Insurance (Lifelong Coverage + Cash Value)

Permanent life insurance stays with you for life—as long as you keep paying the premiums. But the big difference is this: it builds cash value.

Cash value is money you can use while you’re still alive. It grows over time, tax-deferred, and can be borrowed against for big needs like emergencies, opportunities, or even retirement income—tax free. You can also use it to pay the policy premiums.

Types of permanent insurance include:

Whole Life – Universal Life – Indexed Universal Life (IUL) – Variable Life

Let’s go through each.

Whole Life Insurance

- Premiums stay the same for life

- The death benefit is guaranteed

- Cash value builds slowly but steadily

- It’s predictable, stable, and great for people who want consistency and guarantees

Universal Life Insurance

- More flexible than whole life

- You can adjust your premiums (within a range)

- Cash value grows based on interest rates set by the insurance company

- You have more control, but you also need to monitor it more closely

Indexed Universal Life (IUL)

- Cash value growth is tied to a stock market index (like the S&P 500)

- You benefit from market gains (with a cap), but you’re protected from losses (with a floor)

- Premiums are flexible

- Can be structured as a powerful tax-free wealth-building and retirement strategy

Variable Life Insurance

- Highest risk, highest potential reward

- Cash value is invested in sub-accounts like mutual funds

- Value can go up or down depending on market performance

What all permanent policies have in common:

- They cover you for life—as long as the policy is in force

- They include a cash value component

- They can be customized for different financial goals

When permanent insurance might be right for you:

- You want lifelong protection

- You want to build wealth tax-efficiently

- You want to use life insurance as a financial tool (not just protection)

- You care about leaving a legacy

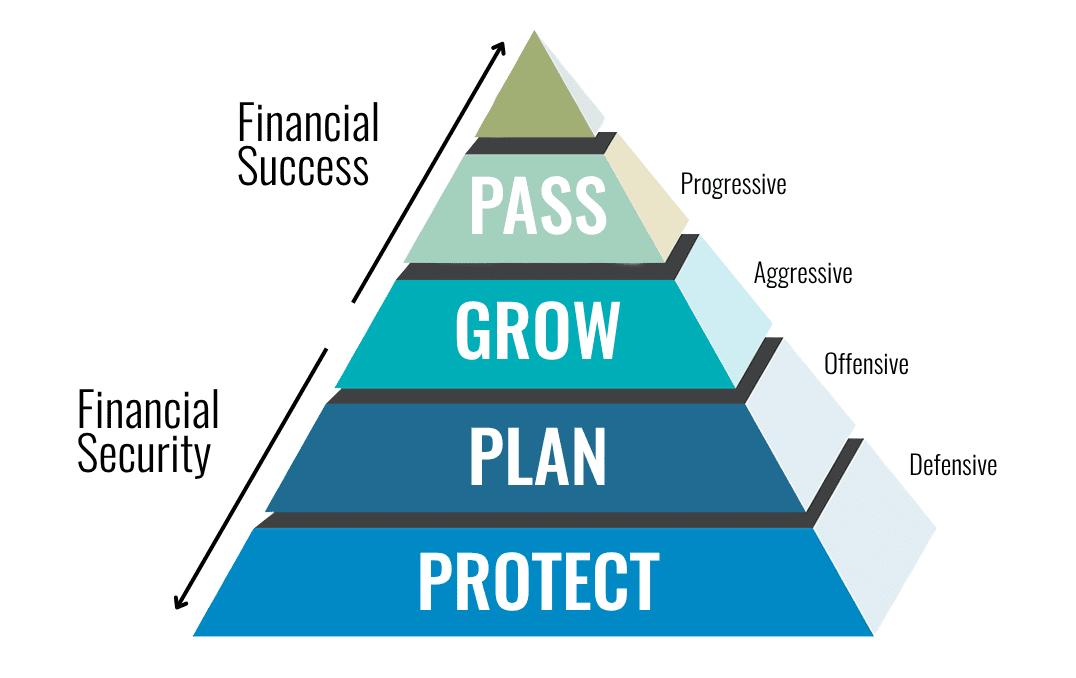

What Can Life Insurance Actually Do?

It can be more than a payout. Here are just a few of the jobs your policy could have:

- Pay off debts or your mortgage

- Replace lost income

- Cover final expenses

- Cover long term care insurance needs

- Pay for terminal, chronic or critical illness expenses

- Fund your child’s college

- Create tax-free income in retirement (with permanent insurance)

- Build generational wealth

- Leave a tax-free inheritance

Your life insurance should have a job. If you’re paying for it, it should be working for you.

So Which Type Is Best?

It depends on what you want it to do.

If you need coverage for a specific timeline (like a 30-year mortgage), term insurance might be the better fit.

If you want lifelong benefits, cash value, and flexibility, then permanent insurance might be the way to go.

A blend of both might make sense too. You could get a larger term policy for temporary protection and a smaller permanent policy that builds value over time.

Cost and Budget Considerations

Life insurance isn’t free, and cost matters.

- Term is cheaper, but only gives you protection for a limited amount of time

- Permanent costs more, but gives you long-term benefits

When looking at the numbers, ask:

- What am I paying monthly?

- What will my family get if something happens?

- What will I have access to later (in cash value)?

- Can I afford to fund this long-term?

- Do I want to pay for a set number of years or for life?

Some people choose to fund their permanent policy heavily in the early years, then stop paying premiums altogether. Others pay monthly for life. It depends on your situation and how your policy is structured.

One Last Thing

Choosing the right life insurance policy isn’t just about comparing prices. It’s about choosing a strategy that matches your goals.

When you’re clear on what you want your policy to do, and you work with the right financial professional to structure it properly, life insurance becomes more than protection—it becomes a powerful financial tool.

If you’re not sure where to start, we can help.

Schedule a time with a financial professional and we will walk you through it.